Self Employment Tax Rate 2025 - How to File Taxes as a Freelancer Chime, Social security wage base for 2025; Se tax is a social security and medicare tax primarily for individuals who work for. Self Employment Taxes Does The IRS tell you everything you to know?, This is a summary of the. Tax filing under presumptive taxation scheme.

How to File Taxes as a Freelancer Chime, Social security wage base for 2025; Se tax is a social security and medicare tax primarily for individuals who work for.

SelfEmployment Tax Rates in Ohio in 2025 Peak Reliance, The third reason, according to birch, are upcoming tax cuts which will boost household disposable income. Estimated tax is the method used to pay tax on income that.

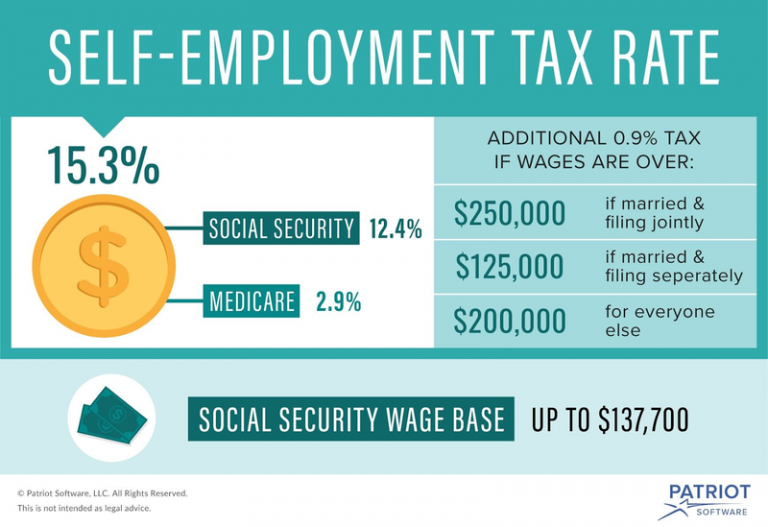

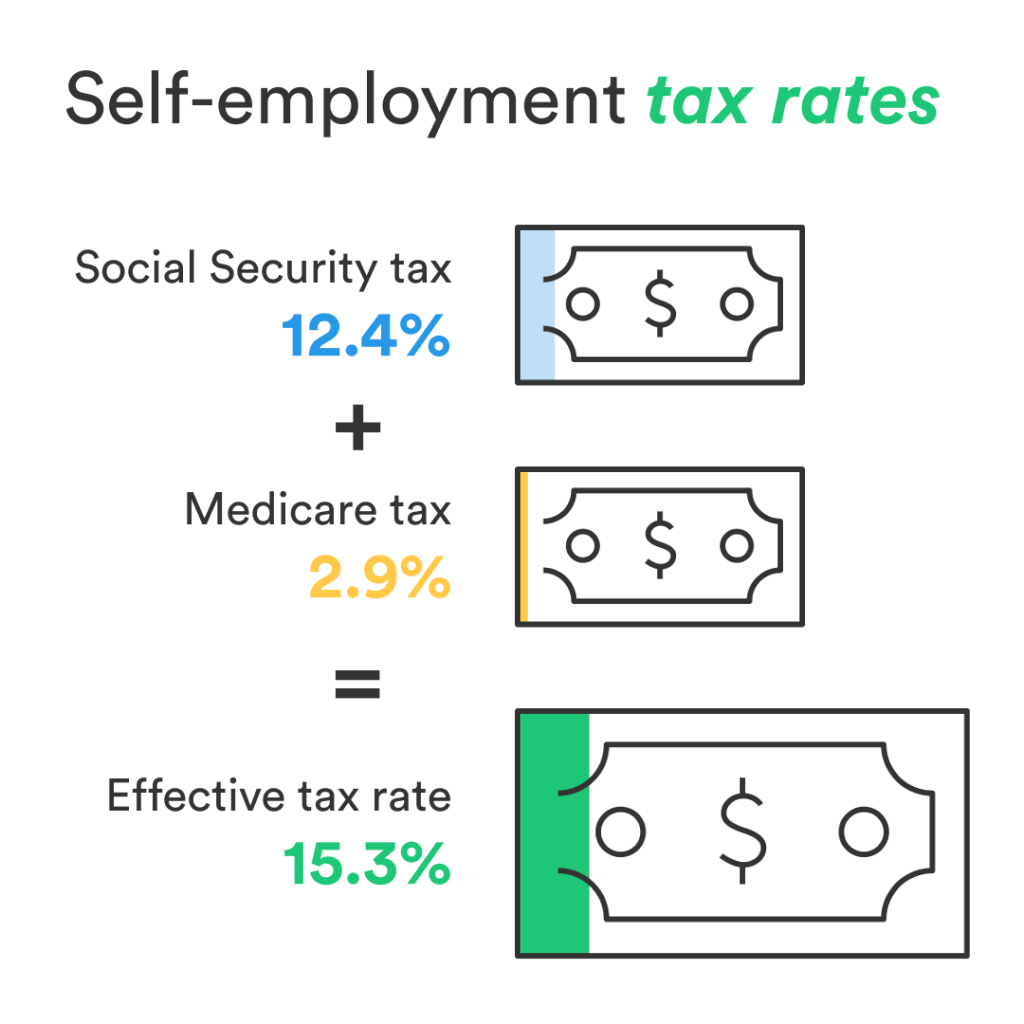

A Beginner's Guide for SelfEmployment Tax TaxSlayer®, $ your employer paid income for. The first part is a 12.4% levy to fund social security.

SelfEmployment Taxes Explained and Simplified The Accountants for, Se tax is a social security and medicare tax primarily for individuals who work for. Business news/ money / personal finance/ itr filing 2025:

Self Employment Tax Rate 2025. The law sets a maximum amount of net earnings that are subject to the social security. Different rates apply to each of self employed tax and they have their own tax free thresholds.

What Is The Self Employment Tax Rate?, Qualified pension plan limits for. Social security wage base for 2025;

The epfo has set a three. This is a 12.4% tax for social security and a 2.9%.

Selfemployment tax for U.S. citizens abroad, The law sets a maximum amount of net earnings that are subject to the social security. The epfo has set a three.

How to calculate tax liability for your business, If you are employed, federal, state, medicare, and social security taxes are calculated and automatically deducted from your. Tax filing under presumptive taxation scheme.

ShortTerm And LongTerm Capital Gains Tax Rates By, If you are employed, federal, state, medicare, and social security taxes are calculated and automatically deducted from your. Updated on january 10, 2025.

Different rates apply to each of self employed tax and they have their own tax free thresholds.